The Ultimate Planning Tool: For prioritizing what you want when you want

Permanent life insurance is often said to be the ultimate planning tool because it facilitates beneficial tax and estate planning opportunities and solutions throughout your lifetime to provide you with peace of mind now and into the future. The earlier in life that your permanent life insurance policy is purchased, the greater the impact it can have as a financial instrument. See how your permanent insurance can be flexible enough to service a lifetime of changing priorities and needs.

What if my priority is:

Insuring my earning power for my heirs?

During your lifetime, you will likely make plans for and have obligations to others that rely on your ability to earn an income. With permanent life insurance you can insure any income that would be lost if you passed away during your income earning years, so that your plans can be carried out even after you’re gone. The advantages of permanent insurance continue well beyond your income earning years.

Contact our office to discuss advantages of permanent life insurance.

Enhancing my investment income?

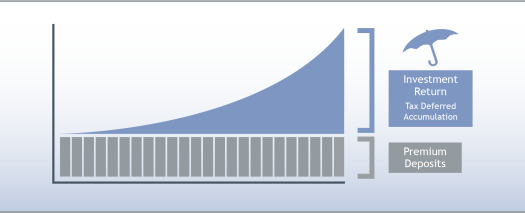

With permanent insurance, there are options to contribute deposits, in excess of the insurance premium, to the policy’s cash value in which any investment growth accumulates on a tax-deferred basis. This can be particularly attractive if you’ve topped up your RRSP and TFSA and have additional funds to invest.

Further down the road, as you strategize your retirement or other cash flow needs, you can decide then how and whether to use the policy cash value as part of your income strategy or use the tax-deferred status of your policy to pass the cash value* to your heirs, tax-free, at your death.

Contact our office to learn more about the advantages associated with the tax-deferred status of your permanent life insurance policy.

*or an additional insurance amount in the case of some whole life plans

Enhancing my retirement Income?

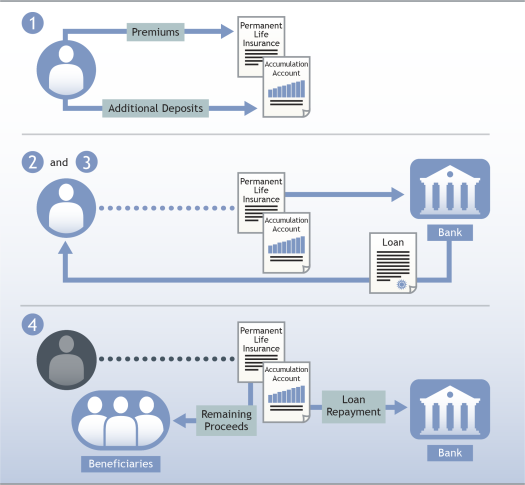

If you purchase a permanent life insurance policy, there are options to contribute deposits, in excess of the insurance premium, to the policy’s cash value in which any investment growth accumulates on a tax-deferred basis. Funding your permanent life insurance policy in this way during your working years gives you the option to use an Insured Retirement Program (IRP) strategy when you retire. With the IRP, retirement income is accessed through a series of bank loans secured by the cash value in your insurance policy. Upon your death, the insurance proceeds are used to pay off the bank loan with any additional proceeds paid tax-free to your beneficiaries.

Contact our office to see if an Insured Retirement Plan is right for you.

Preserving my capital during retirement?

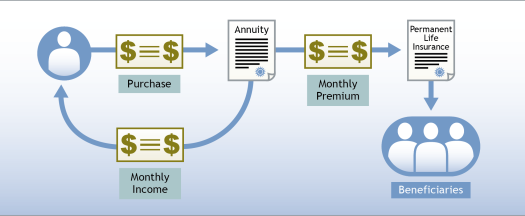

Some retirement vehicles, like life annuities, produce the greatest monthly income when you also accept the downside. The downside is that the payments stop at your death, regardless of how much has been paid out, so there’s nothing left for your heirs.

If you’re thinking of optimizing your retirement income with a Life Annuity, your permanent life insurance policy can be used to replace the original capital you invested to your heirs.

Contact our office to see if an insured annuity strategy is right for you.

Providing equally for my heirs?

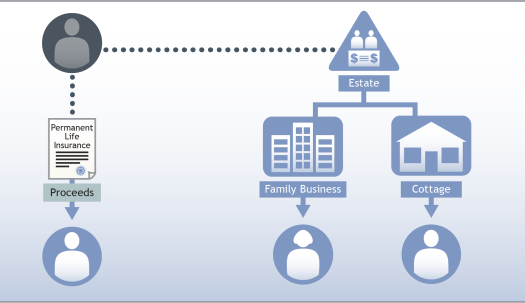

Any time during your lifetime, you can dedicate some or all of the proceeds of your permanent insurance plan to the equalization of inheritance amongst the heirs of your estate. This works especially well in cases where specific bequests, like a business or real estate are being passed to a specified heir. Your permanent life insurance proceeds can be used to pass on an equivalent value to heirs that don’t receive specific bequests.

Contact our office to learn more about dedicating your permanent life insurance proceeds to estate equalization.

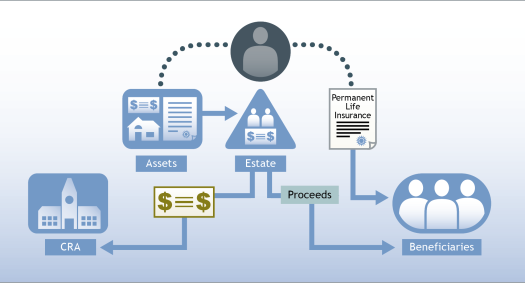

Preserving my legacy?

Capital property like real estate, shares in a private corporation, or investments in stock market shares all attract tax on the death of their owner unless they’re passing to your spouse.

Proceeds from your permanent life insurance policy can be paid to your beneficiaries to offset the amount of capital gains tax paid, restoring your estate to its pre-tax value.

Contact our office to learn more about funding your capital gains tax liability using life insurance.

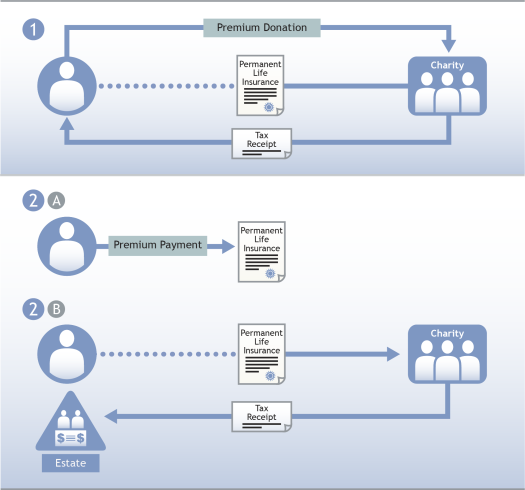

Leaving a charitable legacy?

You can use your permanent life insurance policy to provide a legacy gift to a charitable organization.

Here are two ways:

1. You could transfer the ownership of the policy to a charity during your lifetime. You’ll receive a tax receipt for the value of the policy at the time of the transfer and, each year for the amount of any insurance premiums you pay. The charity receives the entire insurance amount at the time of death.

2. You could retain ownership of the policy and designate the charity as beneficiary. Your estate will receive a tax receipt for the entire insurance amount at the time of death.

Contact our office to learn more about charitable gifting using permanent life insurance.